The fintech sector is one of, if not the most, competitive segment of the technology industry.

This implies that for a fintech startup to survive, it has to be aggressive at branding so that it stands out or be really innovative so that it offers what others won’t be able to easily replicate.

To give an example, in Uganda today, we have mobile money services offered by telecom companies, applications that enable online payments and other financial transactions, integrators that link retail apps/websites to mobile money wallets and bank accounts.

Banks have also rolled out mobile banking applications.

So, on one side we have an unknown, underfunded startup and on the other, there’s an established multimillion dollar telecommunications company or banking institution; and two are competing for the same market.

But the above begs the question: How are these small startups able to survive and play alongside bigger companies? Coming up with unique services and creating trusted brands.

For instance, seeing that telecommunications companies were aggressively eating into their market, banks rolled out agency banking and mobile apps to compete with mobile money.

But, a service like agency banking will still need more infrastructure and not everyone has a phone that supports a mobile application so banks still have to partner with telecom companies and integrators to serve people interested in using the USSD code for mobile financial transactions.

Another example is of third-party applications. While it’s now possible to purchase some goods and pay bills with a telco’s mobile money service, it limits you to a certain telecom company instead of using a third-party mobile wallet that allows cross mobile money exchanges.

For instance, it’s impossible to buy airtime for an Airtel number using MTN mobile money, but with a third-party application, this is very possible.

What is Xente doing?

Xente, a brainchild of Allan Rwakatungu and Francis Nkurunungi, is one of Uganda’s fast-rising online service providers and in a year and a half since its founding, it has demonstrated its performance and scalability, attracting support from different organizations, including the government.

The company declined to reveal the portion they took from the more than Shs2 billion government gave to 12 startups. Xente’s publicist Lyn Tukei says they are using the money for their expansion projects.

In August we broke the news that Xente was planning to expand to three other African countries, namely Nigeria, Kenya, and South Africa.

In our recent interview, Tukei said they had already secured partnerships in Nigeria and before this year ends, they’ll already be operating in the populous west African country.

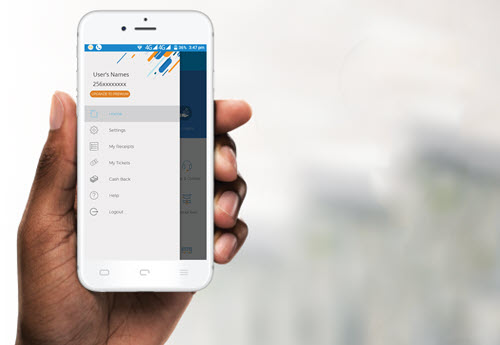

Aside from its continental ambitions, Xente has also been expanding the scope of services it offers on the Xente app.

The Xente app can now only be accessed from the Google Play Store. Tukei says the iOS-based app is still being developed.

Specials offers and services added to Xente app

The most recent addition to the Xente app is the lending service, where you can buy items or make any other online financial transaction and pay the company later.

This is a concept similar to mobile money loans, only that here you’re not limited to a particular telecommunications company. They’ve made the KYC process a bit sophisticated by requiring a national ID to reduce chances of defaulting payments.

According to Tukei, they introduced the service to enable people who may not have immediate cash on their mobile money or Xente wallet to be able to make purchases.

She says they’ll also introduce cash loans in the near future so that you can use the Xente app to withdraw a cash loan by either mobile money or your bank.

The idea of obtaining loans though not yet popular in non-banking institutions in Uganda, it has shown steady growth with mobile money.

Recently, MTN and Airtel revealed that they had given out more than Shs100 billion in mobile loans in three years.

Must read: How to withdraw money from an ATM without a card

Xente has also entered a partnership with UgaBus to allow users of Xente app to book for bus tickets from Kampala to Arusha, Busia, Dar-Es-Salaam, Dodoma, Eldoret, Nairobi, Kigali among other East African cities.

Using the application, you can also buy tickets to watch movies at Kampala cinemas like Cinema Magic, Century Cinemax, Numax Cinema and Cinemax.

This coming week, according to Lyn Tukei, they are introducing a special offer where users can buy tickets for as little as Shs5000 to enjoy a movie night from Cinema Magic and Century Cinemax. They normally trade at Sh10,000 and beyond.

Other services you can access via the Xente app are airtime, data and voice bundles, subscription television, event tickets (in partnership with Quicket) and utilities.

Tukei told me they are also going to start facilitating school fees payments “soon”. The section of school fees payment is on the app but it’s inactive.

Webshop

One other great feature Xente is introducing is an online shop. Developers at Xente are setting up sub-domains for retailers to sell their products, for instance, Tecno and HTC have already inked the deal.

The company also wants to provide an open API so that businesses can leverage the Xente payment gateway to carry out financial transactions.

Do these strategies mean an assured win for Xente? Your guess is as good as mine.

But for a fact, the mobile industry is continuously growing and people are increasingly embracing mobile and cashless payments.

A recent report by the Bank of Uganda showed that there was a 44% growth in mobile money transactions, with Shs63.1 trillion moved between December 2016 and December 2017.

More than 20 million people are registered on mobile money platforms in Uganda, which is the second largest mobile money market in Africa after Kenya, according to reports.

Another survey by GSMA has shown that the number of mobile subscribers in Sub-Saharan Africa will grow from 444 million in 2017 to 634 million in 2025.

Another important factor to note is that youths make up the largest fraction of the population, implying the market for technology will continue to grow so it’s up to the innovators to work towards attracting this huge market, which, by the way, is continuously becoming hard to impress.

Related:

Leveraging IoT, Jaguza Livestock App set to transform livestock farming in Africa

Cipla Quality Chemicals lists over 600m shares on Uganda Securities Exchange