The word ‘SafeBoda’ is now a household name for the majority of Ugandans who especially use Boda Bodas – motorcycles for movement in Kampala Metropolitan region. For many Ugandans, riding on a Boda boda used to be an unsafe experience because the riders were reckless, didn’t have customer care and you couldn’t bargain because you didn’t know the right price for your trip.

But ever since its entry into the Ugandan market in 2015, SafeBoda has by far revolutionized the boda boda business with uniquely identifiable personnel, fair prices, road discipline, and a trustable workforce.

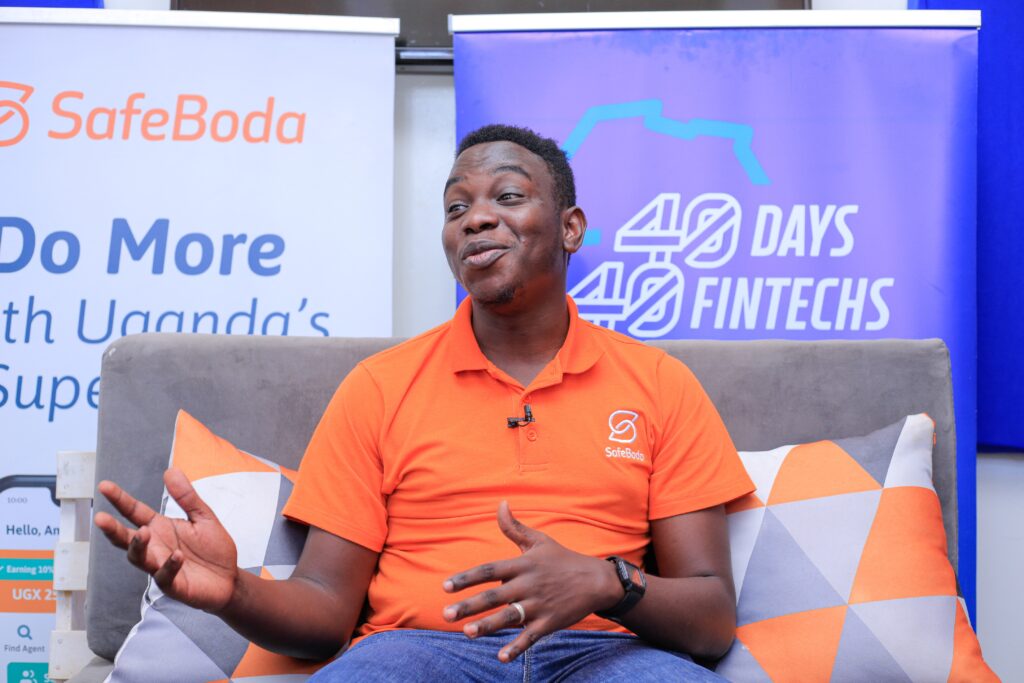

According to Christian Wamambe Mayeku, the Head of Financial Innovations at SafeBoda, health and safety were the blueprints behind building a successful Boda Boda hailing business in Uganda that has grown from two riders in 2015 to over 26,000 riders in 2022.

“We introduced transparency because the rider and customer are able to know the fair price for a trip. We have trained riders in safety, they have two helmets and do not speed through cross-sections, they stop at traffic lights and really try to provide as much safety as possible,” he explains, noting that they have since entered new markets like Ibadan in Nigeria and the business is growing because the demand for such a service is great across Africa.

Wamambe says SafeBoda’s vision is to provide affordable and convenient services to people in African cities. To do that, they have had to evolve from just a ride-hailing app into a super app.

“With your SafeBoda App today, you can do a lot beyond ordering a Boda Boda. You can pay for electricity, water bills, airtime, and order from a shop or supermarket or restaurant – all using an affordable app,” he says.

On top of that, SafeBoda now has a growing Agents’ network that makes transactions even much easier.

“In January, we were granted a license by the central bank to create an agent network. So, the goal of this is to help people who do not have a smartphone or access to financial services,” he explains.

Wamambe says a person can walk to a SafeBoda agent and buy or pay all their bills at an affordable rate. This segment is also growing because they are the same shops that do mobile money, agent banking and all sorts of businesses. So, SafeBoda is tapping into them by giving them a new way of making money.

The other ever-growing product that SafeBoda is offering is Food and Shop. Here, they partner with recognized restaurants, shops, and value chains like KFC to provide services to people. Riders are able to earn extra income by delivering food and goods to clients at very affordable prices.

40 Days 40 FinTechs

Wamambe notes that while the FinTech environment is on the rise, the main challenge is that the market is still very fragmented, thus the high transactional costs.

“But we are seeing a convergence. Telecoms are starting to work closely with banks and FinTechs and the government is paying attention to addressing all these barriers…We will in the future become like Safaricom in Kenya where it is very easy to move money across your telecom line or your bank account or in the US where money is moving swiftly,” he says, before appreciating HiPipo for the third edition of 40Days40FinTechs initiative that has brought awareness about the FinTech industry and Financial Inclusion in general.

“For many people, it is the first platform where you get to know the little FinTechs that are doing great for their customers. This helps them forge partnerships with larger players like banks and multinationals to grow their impact to society,” he says.

SafeBoda is the 24th participant in this year’s edition of #40days40Fintechs.

According to HiPipo CEO Innocent Kawooya, FinTechs such as SafeBoda are testament to the fact that the digital business can survive and thrive.

“SafeBoda started with two riders and now has more than 26,000 riders that serve over one million clients. This proves that our people can ably adopt digital products if they are convenient, affordable and user-friendly,” he said.

Kawooya added that this year’s edition seeks to cement the achievements of the previous editions – where over 60 FinTechs have been transformed – but also build on them to leverage digital financial inclusion in East Africa and beyond.

The #40Days40FinTechs platform is run under HiPipo’s Include Everyone program that also encompasses other initiatives such as FinTech Landscape Exhibition, Women in FinTech Hackathon, Summit & Incubator and the Digital and Financial Inclusion Summit and Digital Impact Awards Africa.

It also offers participants useful tools and an introduction to the industry’s emerging technologies, such as Mojaloop Open Source Software, and guidance from Level One Project foundational material. The skills gained from this initiative cover Level One Project Principles, Instant and Inclusive Payment Systems (IIPS), Inclusive Finance and FinTech in general.