It is an obligation for you to pay taxes to Uganda Revenue Authority (URA) and fees to the Kampala Capital City Authority (KCCA) – if at all you have a running business or enterprise in the city. This post basically details to you how you can fulfil these obligations with much ease.

Pay URA taxes and fees using MTN Mobile Money

The authority has a partnership with MTN to facilitate payment of taxes using MTN Mobile Money. MTN customers can pay their URA fees and taxes using MTN Mobile Money by dialling *165#, selecting ‘Fees and Taxes’ and then choosing URA.

There are two payment options: with a Payment Reference Number (PRN) or without PRN.

Pay KCCA fees using MTN Mobile Money

Kampala Capital City Authority (KCCA) is responsible for the assessment, collection and accountability of revenues collected from revenue sources such as trading license, fees, ground rent, property tax, penalties/fines, rentals, hotel tax and other fees collected from various City operators.

MTN customers can pay their KCCA licenses, fees and taxes using MTN Mobile Money. All you have to do is dial *165#, select ‘Fees and Taxes’ and then choose KCCA.

Thereafter, you will have to enter the payment reference number, the amount and then confirm payment by entering your MTN Mobile Money PIN.

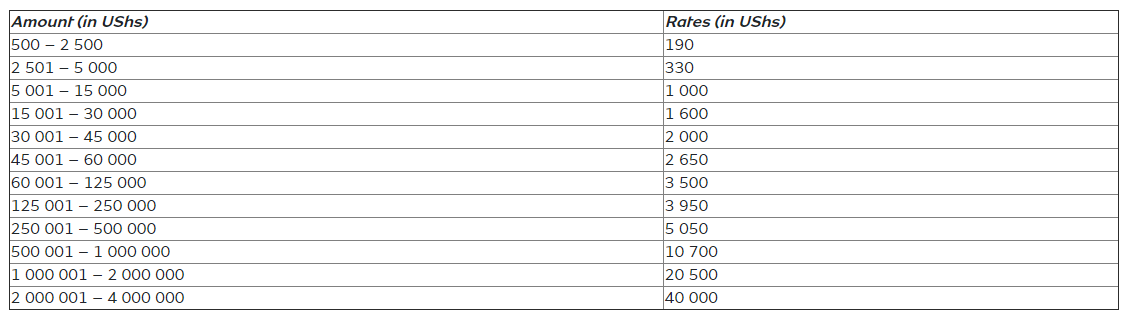

How much are you charged?