Ever been stranded during an awkward time with no mobile money agent around to come to your rescue? Or perhaps you need to withdraw a large amount and the nearby agent doesn’t have enough money (float). No need to worry, anymore; MTN allows its customers to withdraw money through bank ATMs that server as intermediaries. The procedure is quick and very simple. Below are the steps.

Withdrawing mobile money from an ATM

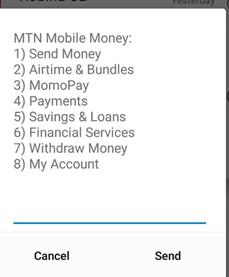

As with the usual mobile money procedure, dial *165# on your device to open the mobile money menu.

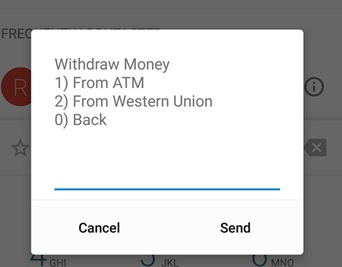

Enter the “withdraw money” option which is currently option 7. This will open the withdraw money menu where you will have to choose “From ATM”.

After selecting the “From ATM” option, this will lead you to another section where you select to generate a one-time password. In order to generate this one time password, you will have to first enter your correct mobile money account password. The one-time password will then be forwarded to your device in a message.

Must read: Mutebile to banks: Cybersecurity must become a priority

This password is only valid for the next 10 minutes after which it expires. Ensure to have this password generated while close to a free ATM.

After the “One Time Password” is sent to your phone, click on any button on the ATM to launch the mobile money interface. This mobile money interface launches once you click a button without an ATM card inserted. If a bank card is inserted, the usual bank interface requesting for the ATM PIN will launch.

Under the mobile money services interface that opens choose the “Withdraw” option. This is currently the only option available in that interface. The machine will now request you for the “One Time Password” you received. Enter this password and then specify the amount to withdraw as soon as the ATM prompts you to. The machine will now forward this request to your phone.

On your mobile phone, click to accept the amount and enter your mobile money password to confirm. The money will now be sent to the Bank and its ATM will provide you with Cash.

The entire process involves usual charges charged by agents. The only difference is this time the ATM will be the agent and the bank will earn the commission. The option works in most banks in Uganda.

Read also:

Agency banking changing the face of finance sector

How Africa is embracing WhatsApp banking